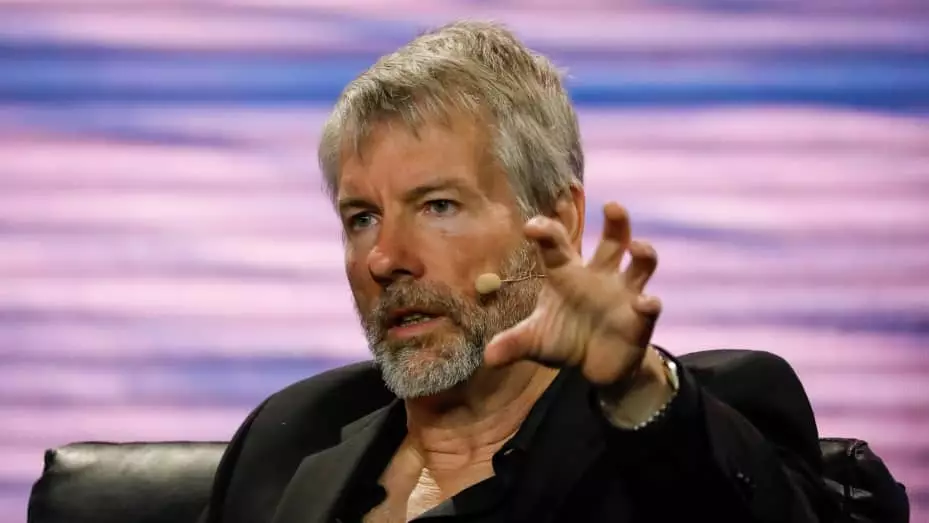

Michael Saylor, former CEO and current executive chairman of MicroStrategy, recently reiterated his commitment to Bitcoin by stating that he and his company would continue to buy the digital asset indefinitely. This move comes despite the fact that MicroStrategy’s BTC holdings have accumulated an unrealized profit of approximately $4 billion. Saylor firmly believes that Bitcoin is the ultimate exit strategy and the strongest asset in the financial market.

In a recent interview with Bloomberg, Saylor highlighted that Bitcoin is not just competing against traditional companies like Apple, Google, and Microsoft. Instead, it is up against asset classes such as gold, the S&P stock market index, and even real estate. According to Saylor, Bitcoin’s technical superiority over these other asset classes will continue to attract capital inflows, making it unnecessary to sell Bitcoin in favor of other assets.

MicroStrategy made headlines in 2020 when it became the first publicly traded company to hold Bitcoin as part of its treasury reserves. Since then, the firm has continued to accumulate BTC, with its most recent purchase of 850 BTC in January bringing its total holdings to 190,000 BTC. At an average purchase price of $31,224 per Bitcoin, MicroStrategy’s BTC stash is now worth over $10 billion.

Saylor’s bullish stance on Bitcoin extends beyond just the present moment. In December, he predicted a surge in BTC demand by 2024, a forecast that is already materializing. With the recent launch of spot Bitcoin exchange-traded funds (ETFs), the demand for Bitcoin has skyrocketed, surpassing the available supply from miners by almost tenfold. Saylor views these ETFs as a landmark development on Wall Street, akin to the creation of the S&P 500 fund.

Michael Saylor’s unwavering support for Bitcoin and MicroStrategy’s significant investments in the digital asset underscore the evolving landscape of the financial markets. As Bitcoin continues to gain mainstream acceptance and outperform traditional assets, Saylor’s visionary approach to embracing disruptive technologies is positioning MicroStrategy as a prominent player in the crypto space.