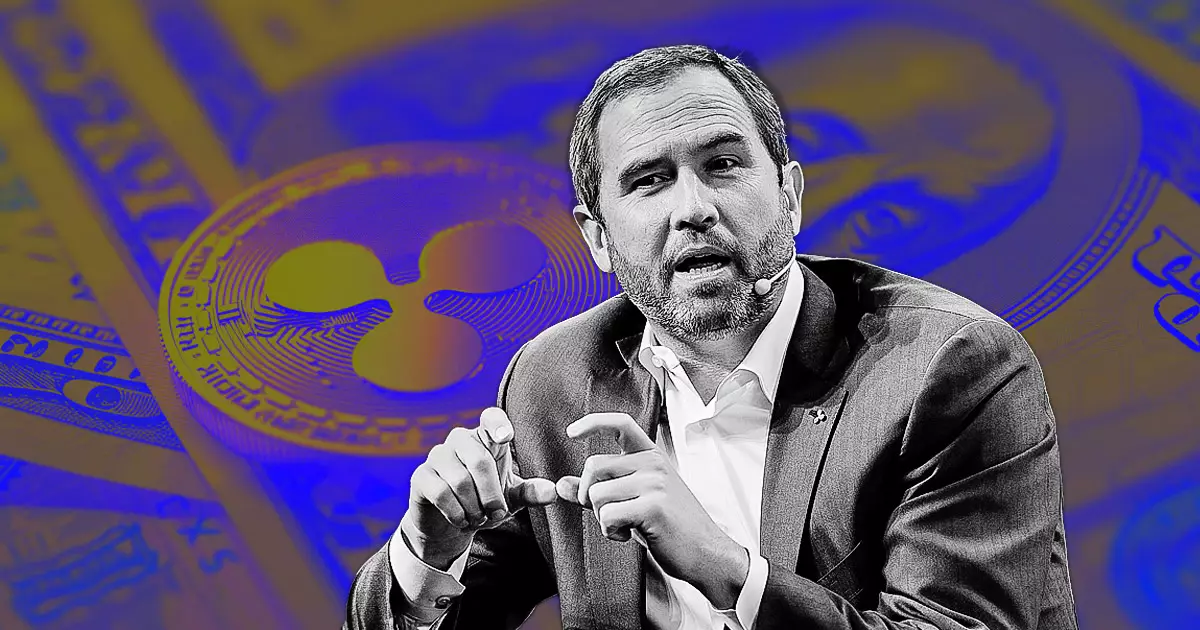

The Securities and Exchange Commission (SEC) has intensified its ongoing legal struggle against Ripple Labs, a case that continues to send shockwaves throughout the cryptocurrency sector. Following a federal court’s mixed ruling in August, the SEC officially initiated an appeal to the Second Circuit Court of Appeals on October 2, 2024. This latest move comes even as Ripple’s leadership, including CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty, expressed palpable disappointment regarding the SEC’s decision. The battle commenced back in December 2020, when the SEC leveled accusations against Ripple, alleging that it had executed an unregistered securities offering that totaled approximately $1.3 billion through the sale of XRP.

The SEC claims that the district court’s ruling contradicts established Supreme Court precedents regarding securities. Ripple, however, had taken comfort in several positive outcomes from the August ruling. Notably, the court found that Ripple’s programmatic sales of XRP on digital asset exchanges did not breach securities regulations, thereby establishing a legal precedent that the crypto industry desperately needed. Despite this, the court also determined that Ripple’s direct sales of XRP to institutional investors—amounting to a significant $728 million—did breach securities laws, culminating in a fine of $125 million.

The August ruling was a double-edged sword. While Ripple celebrated the portion affirming the legality of its sales to retail investors, the resulting penalty still marked a significant setback. Originally, the SEC’s litigation sought up to $2 billion in penalties, thus the $125 million outcome offered fluctuating interpretations of ‘victory’ for both parties involved. However, the ambivalence of the ruling is underscored by a broader confusion within the regulatory landscape regarding cryptocurrencies and how they fit into existing legal frameworks.

Many experts believe this case is more than just a legal dispute; it reflects the evolving relationship between technology and regulation. As cryptocurrencies gain traction in global finance, the SEC’s intensified scrutiny of Ripple could foreshadow a broader crackdown on other blockchain projects. The SEC’s resolve can also be perceived as its further attempt to bring clarity and order to a sector rife with speculation and uncertainty, even if its methods are considered controversial by some.

In light of the SEC’s appeal, Garlinghouse and Alderoty’s reactions depict a struggle not only for Ripple but for the wider cryptocurrency ecosystem. In a public statement, Garlinghouse expressed his frustration about the SEC’s ongoing battle, highlighting what he sees as an unjust expenditure of taxpayer dollars on a case he believes the agency has mostly lost on critical points. He firmly holds that XRP’s classification as a non-security remains legally valid, irrespective of the appeal.

This perspective draws attention to a critical discourse surrounding regulatory practices in the financial technology space. Critics argue that the SEC, under Chair Gary Gensler, is engaged in what has been termed “litigation warfare” against the crypto sector, fostering an atmosphere of fear and unpredictability. Alderoty voiced similar sentiments, emphasizing that the court concluded there were no identifiable victims or losses—a point he believes should have led to a different regulatory approach by the SEC.

The SEC’s announcement reverberated through the crypto markets, resulting in a notable decline in XRP’s value. Reportedly, XRP dropped about 9% in value over just 24 hours, trading around $0.54. This volatility illustrates how regulatory developments can lead to rapid shifts in investor sentiment and market behavior. With XRP now ranked seventh by market capitalization, its performance is closely observed, serving as a barometer for the health of the broader cryptocurrency market.

As of October 3, 2024, the total market capitalization of cryptocurrencies stood at approximately $2.12 trillion, and Bitcoin maintained its dominance at around 56.74%. Ripple’s legal saga thus becomes emblematic of a larger narrative—one wherein the future of cryptocurrencies hangs in the balance as the SEC and other regulatory bodies navigate how best to address this transformative yet tumultuous financial frontier.

The ongoing legal battle between Ripple Labs and the SEC foreshadows critical implications for the entire cryptocurrency sector. As both sides prepare for what could be a protracted legal journey, the question remains whether clarity or further confusion will emerge regarding XRP and similar digital assets. One thing is for certain: the reverberations of this case will likely be felt across the cryptocurrency landscape, making it imperative for stakeholders to closely monitor how it unfolds in the coming months.