The Bitcoin price is once again on the rise, as bullish sentiment takes over the market. With the price currently standing at $37,422, up 4.2% in the past 24 hours, Bitcoin has outperformed all other asset classes this year, boasting a 123% gain. This upward trajectory has attracted the attention of traders, who are eagerly awaiting the approval of a spot Bitcoin ETF by the US Securities and Exchange Commission (SEC). Meanwhile, alternative investment propositions, such as Bitcoin Minetrix, are gaining popularity in the market.

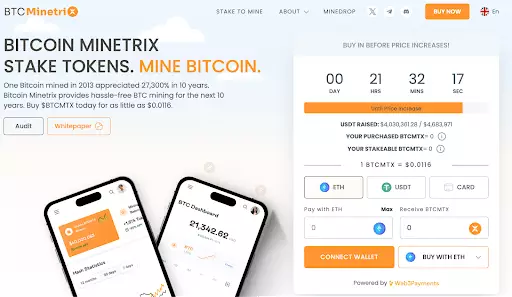

In the midst of the excitement surrounding a potential spot Bitcoin ETF approval, Bitcoin-related coins, like Bitcoin Minetrix ($BTCMTX), are gaining traction. Bitcoin Minetrix offers a unique value proposition by tokenizing the cloud mining of Bitcoin. Built on the Ethereum blockchain, users of Bitcoin Minetrix stake the native $BTCMTX token and receive cloud credits to mine Bitcoin. This approach presents several advantages, including ease of use, low entry cost, and protection against scammers. These advantages have attracted significant interest, as the ICO of Bitcoin Minetrix has exceeded $4 million.

While the exact height of the Bitcoin price surge remains uncertain, many analysts believe that it could reach multiples of $100k. This optimism is fueled by the market value to realized value ratio (MVRV), which indicates that the average Bitcoin holder is in profit. As the market appears to be coming off the bottom, investors are looking for new opportunities to participate in the bull cycle. Tokens like Bitcoin Minetrix offer an enticing way to get involved and potentially benefit from the upward trend in the market.

The announcement by BlackRock, the largest fund manager globally with assets under management of $8.54 trillion, that it has applied to launch a spot Bitcoin ETF marks a significant milestone for crypto assets. The entry of a well-established player like BlackRock into the market is expected to attract billions of dollars into the crypto space. Financial advisors and pension fund managers, who were previously barred from investing in Bitcoin or Ethereum, will now have a regulated route to allocate clients’ funds to these assets. This approval will bring much-needed credibility to the asset class and could have a seismic impact on the largest capital market in the world, the US.

As the price of Bitcoin continues to rise, the number of Bitcoin wallet addresses valued over $1 million is expected to increase. This growth will also be fueled by high net worth individuals entering the market and the Bitcoin mining industry. Bitcoin Minetrix, with its innovative approach to tokenized cloud mining, is positioned as a top contender among Bitcoin alternatives. Investors in Bitcoin Minetrix can benefit from both capital and income growth. While the value of the coin is tied to the overall performance of Bitcoin, its mining rewards provide additional income for token holders. Furthermore, the tokenized cloud mining model eliminates the need for capital expenses related to mining rigs, making it highly profitable for participants.

Adding to the bullish sentiment is the observation that Bitcoin balances on exchanges are at a five-year low. This phenomenon aligns with the supply shock thesis, suggesting that the scarcity of Bitcoin on exchanges could further drive up its price. With limited supply and increasing demand, the conditions are set for a potential price surge.

The Bitcoin market is experiencing a resurgence, with the price retracing higher and setting sights on $40,000. The impending approval of a spot Bitcoin ETF by the SEC has created a sense of anticipation among traders and investors alike. Alternative investment propositions, such as Bitcoin Minetrix, are gaining attention for their unique value propositions and potential for growth. As the market continues to evolve, the dynamics of supply and demand, as well as the emergence of innovative solutions, will play key roles in shaping the future of Bitcoin and the broader cryptocurrency landscape.