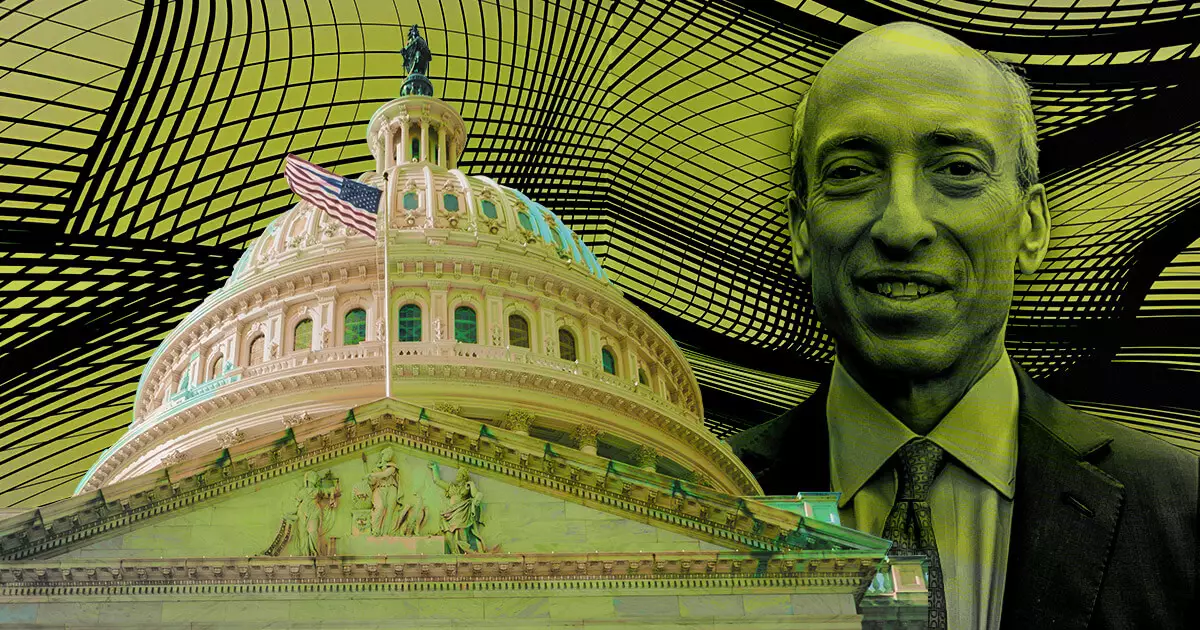

In a surprising and audacious move, U.S. Congressman Warren Davidson, with the support of House Majority Whip Tom Emmer, has made a compelling case for the dismissal of SEC Chair Gary Gensler in 2024. Citing alleged corruption and abuses of power, Davidson’s stance reflects the escalating tensions between the SEC and the digital asset sector throughout 2023. This article will delve into the motivations behind Congressman Davidson’s proposal and explore the potential implications of removing Gensler from his position.

Davidson is gravely concerned about Gensler’s enforcement-first regulatory approach, which he believes has strained the SEC’s relationship with the digital asset industry. By prioritizing enforcement over collaboration and dialogue, Gensler’s stance has potentially hindered the growth and innovation of the sector. This has led Davidson to advocate for a reform that goes beyond the removal of Gensler from his role.

Earlier this year, Davidson introduced the SEC Stabilization Act as a means to address the issues plaguing the SEC under Gensler’s leadership. This proposed legislation aims to restructure the SEC and increase transparency while preventing political agendas from influencing the decision-making process. The Act proposes the addition of a sixth commissioner and an Executive Director to ensure effective oversight of day-to-day operations. Despite the proposed restructuring, all rulemaking, enforcement, and investigation powers would remain with the commissioners.

Safeguarding U.S. Capital Markets

By limiting any single political party from holding more than three commissioner seats, the proposed restructuring seeks to safeguard U.S. capital markets from potential political agendas. The goal is to ensure that the interests of American investors and the industry take precedence over partisan maneuvering. Davidson, stressing the urgency for reform, asserts that “U.S. capital markets must be protected from a tyrannical Chairman, including the current one. It’s time for real reform and to fire Gary Gensler as Chair of the SEC.”

Support and Criticisms of the SEC Stabilization Act

Emmer has expressed his support for Davidson’s stance, emphasizing the need for clear and consistent oversight that serves the interests of American investors and the industry as a whole. Tweets from various supporters also echo the sentiment for Gensler’s removal and the passage of the SEC Stabilization Act. One tweet specifically calls for an end to the accredited investor rule, alleging that it protects the interests of a privileged class. Another tweet accuses Gensler’s SEC of favoring Wall Street over Main Street and endorses Davidson’s bill as a means to hold the SEC accountable.

The proposal to remove SEC Chair Gary Gensler marks a critical juncture in the ongoing dialogue about regulatory approaches and accountability within the U.S. financial regulatory framework. While some applaud Davidson’s efforts to address alleged corruption and abuses of power, others argue that stability and continuity are crucial for effective regulation. As the debate unfolds, it remains to be seen whether the SEC Stabilization Act gains traction and whether a new era of regulation will emerge in the digital asset sector.