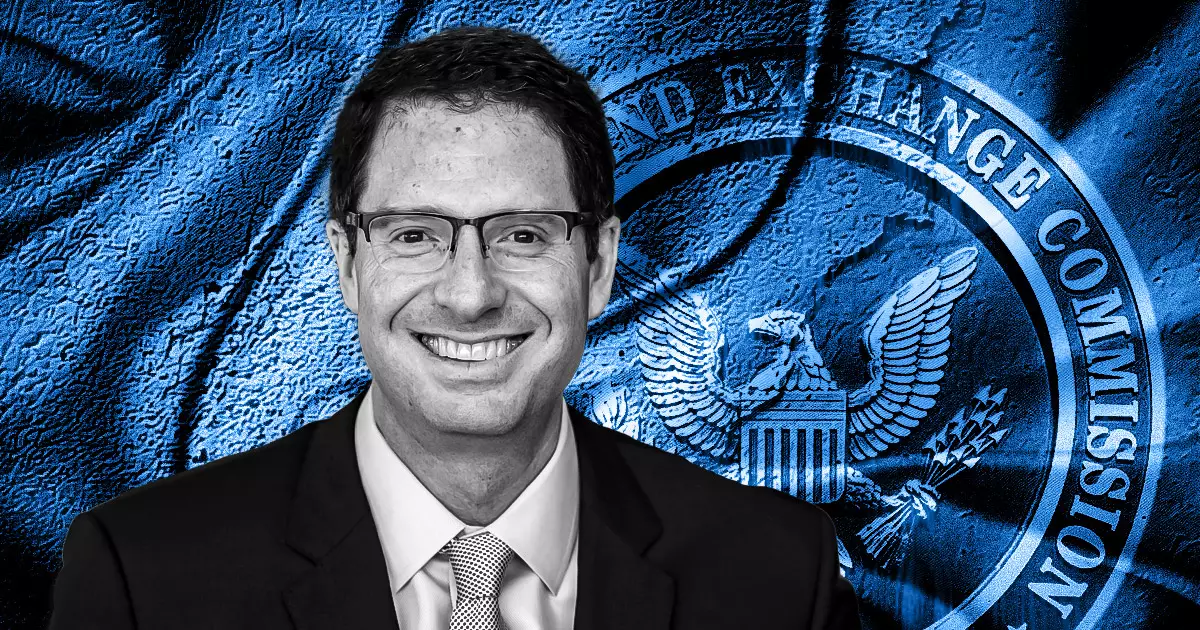

The cryptocurrency community is abuzz following Jesse Powell’s endorsements of Brian Brooks, the former acting US Comptroller of the Currency, as a viable candidate for the role of Chair of the Securities and Exchange Commission (SEC). In a recent post, Powell praised Brooks for his comprehensive knowledge not only in the realm of cryptocurrency but also about the broader regulatory ecosystems that the SEC governs. This call for Brooks’ leadership stems from rising concerns over the SEC’s deviation from its primary functions, which some believe has negatively affected both American businesses and the integrity of financial markets.

Powell’s critique of the SEC is particularly timely, considering the evolving challenges within the crypto landscape. The agency, under the leadership of Gary Gensler, has faced scrutiny for its vague regulations and enforcement actions that appear reactive rather than proactive. Powell’s remarks indicate a growing frustration with regulatory approaches that seem misaligned with industry innovation. This sentiment resonates with many stakeholders who argue that clarity and consistency in regulations are critical for the growth of the cryptocurrency sector and for maintaining competitiveness in the global financial arena.

Eleanor Terrett from Fox Business underscored Brooks’ potential fit for various financial regulatory positions, notably at the SEC, while also mentioning the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), and several other financial oversight entities. Brooks’ background brings a unique perspective to these roles, having served in capacities that navigate the intersection of finance and regulation. His knowledge could be instrumental in aligning the SEC with current and future trends in digital assets and promoting a regulatory framework that supports innovation without stifling it.

As discussions around Brooks’ candidacy unfold, other heavyweight candidates are also in the mix. Figures like SEC Commissioner Hester Peirce, often dubbed “Crypto Mom,” and former CFTC Chair Christopher Giancarlo, referred to as “Crypto Dad,” represent varying perspectives on how the SEC should approach digital assets. Prediction markets like Kalshi indicate that Brooks currently ranks lower in potential as SEC Chair with a 16% likelihood, yet his appointment could be transformative if he manages to foster collaboration between regulators and innovators in the cryptocurrency domain.

Brooks himself has remarked on the substantial groundwork laid during Donald Trump’s previous administration, which encouraged banks to embrace digital assets and provided clarity on stablecoin regulations. These developments have been crucial in legitimizing decentralized technologies. Should Brooks step into the role of SEC Chair, he could leverage these existing frameworks to push for further advancements in cryptocurrency regulation, paving the way for clearer policies that would benefit both consumers and industry players alike.

The prospect of Brian Brooks leading the SEC has prompted both excitement and skepticism within the financial community. His proven track record and distinct insights into the cryptocurrency landscape present an opportunity to reshape the relationship between regulators and the digital asset industry. As the appointment process unfolds, the key question remains: can Brooks navigate the complexities of this evolving financial landscape effectively?