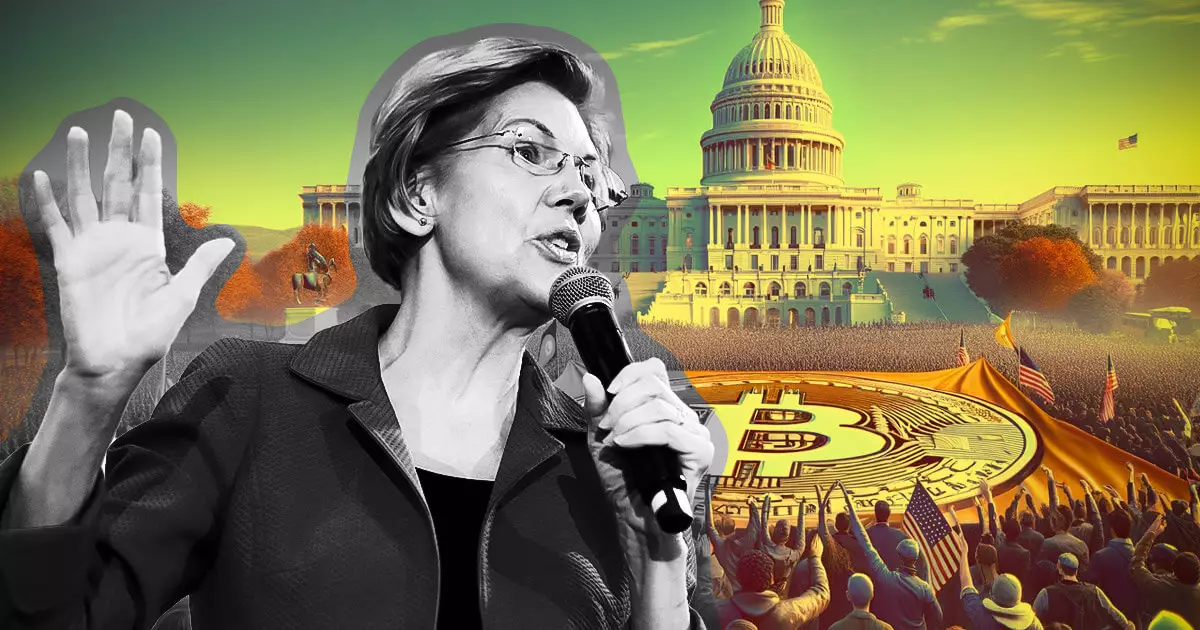

Senator Elizabeth Warren has recently voiced her willingness to work with the crypto industry, but only under the condition that players within the industry adhere to regulatory standards comparable to those in traditional finance. In a Bloomberg interview on Feb. 27, Warren expressed her desire to collaborate with the industry, while also criticizing the industry’s apparent tolerance for illicit activities such as drug trafficking, human trafficking, terrorism financing, ransomware scams, consumer scams, and support for rogue nations like North Korea. This stance has drawn both support and criticism from stakeholders within the crypto industry.

Warren’s approach to crypto regulation has faced steep criticism from some quarters of the burgeoning industry, with accusations that her proposed policies might hinder innovation and drive talent and capital overseas. One prominent pro-crypto lawyer, John Deaton, who is challenging Warren’s seat in the Senate, accused her of engaging in a “politics of division and destruction.” This criticism highlights the ongoing debate within the crypto sector regarding the appropriate level of regulatory oversight and the potential impact on industry growth and innovation.

Senator Warren emphasized the importance of having uniform regulatory standards across the US financial landscape, pointing out that while major traditional financial entities such as banks, credit unions, and stockbrokers adhere to established regulations, the crypto industry remains largely unregulated. She called for the crypto sector to adhere to existing rules, arguing that the same set of rules should apply to all participants in the financial system, regardless of the nature of their operations.

In her advocacy for regulatory parity, Warren highlighted the similarities in activities and associated risks between traditional finance and crypto finance. She stressed the importance of enforcing existing laws rather than creating new regulations, emphasizing the need for a level playing field for all participants in the financial system. Warren’s proposed legislation, the Digital Asset Anti-Money Laundering Act, aims to bring the crypto ecosystem into greater compliance with anti-money laundering frameworks that govern the traditional financial system.

Overall, the debate over crypto regulation continues to evolve, with Senator Warren’s stance on the matter attracting both support and criticism from various stakeholders within the industry. As discussions around regulatory standards and enforcement mechanisms intensify, finding a balance between fostering innovation and addressing the risks associated with crypto activities remains a key challenge for policymakers and industry participants alike.