Recently, former Commodity Futures Trading Commission (CFTC) Chair Christopher Giancarlo made headlines by quelling rumors surrounding potential appointments to key regulatory positions, specifically the U.S. Securities and Exchange Commission (SEC) Chair and a crypto-related role at the U.S. Treasury Department. Giancarlo, whose tenure at CFTC was marked by an openness to cryptocurrency, vehemently denied any interest in these positions, proclaiming, “I’ve made clear that I’ve already cleaned up earlier Gary Gensler mess [at] CFTC and don’t want to have to do it again.” His remarks hint at the complex tensions that exist within the regulatory framework surrounding cryptocurrencies in the United States.

Giancarlo’s references to a “mess” seem to allude to the SEC’s controversial “regulation by enforcement” strategy, which has faced scrutiny even from within the agency. One SEC Commissioner labeled this approach a “disaster,” with heavy implications for the cryptocurrency market. Under the current SEC Chair Gary Gensler, a significant focus has been placed on distinguishing between various digital assets, determining which should fall under securities law. While Gensler insists that Bitcoin is not classified as a security, he warns that many of the thousands of altcoins likely qualify, potentially subjecting them to a more rigorous regulatory framework. This creates an environment rife with uncertainty and concern, which Giancarlo appears reluctant to navigate once more.

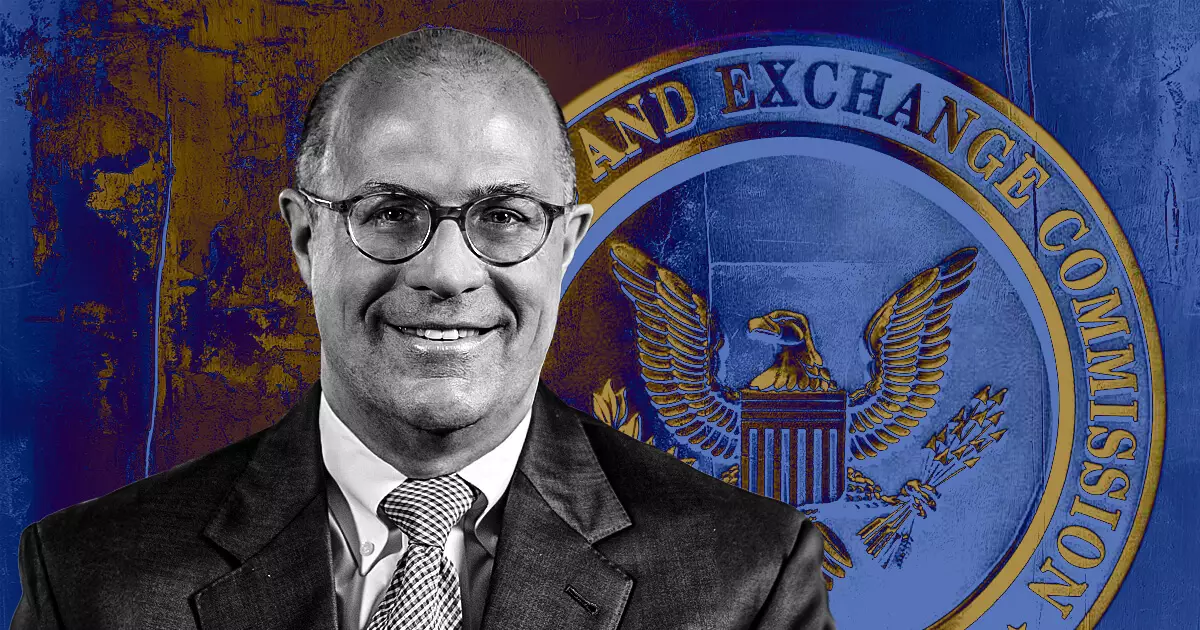

Giancarlo, affectionately dubbed “Crypto Dad,” has garnered respect for his relatively progressive stance on digital currencies since 2018, when he stated, “Cryptocurrencies are here to stay.” His ongoing involvement with the U.S. Digital Chamber of Commerce highlights his commitment to fostering a more accommodating environment for cryptocurrencies. This stands in stark contrast to Gensler’s perspective on strict regulation as a means to protect the public from potential fraud and instability within the sector. The dialogue between Gensler and Giancarlo reveals a significant rift in how regulatory bodies perceive their roles against the backdrop of the rapidly evolving crypto market.

Since Gensler took over in 2021, the SEC has ramped up its enforcement actions, filing lawsuits against several high-profile crypto exchanges such as Kraken, Binance, Ripple, and Coinbase. These actions have drawn considerable criticism, with industry insiders and observers voicing concerns that the SEC’s aggressive tactics lack clarity and may stifle innovation. Critics argue that rather than clarifying regulatory guidelines, the SEC is fostering an environment of uncertainty, which could hinder the growth of the cryptocurrency ecosystem in the U.S.

The dialogue between regulatory approaches, illustrated by figures like Giancarlo and Gensler, highlights the ongoing struggle to balance investor protection with facilitating innovation. As the landscape for digital assets continues to grow more complex, the enduring tension between regulatory clarity and enforcement may define the future of cryptocurrency regulation in the United States. As stakeholders from various sectors evaluate this unfolding regulatory framework, the voice of advocates like Giancarlo remains a critical element in shaping a more constructive path for digital assets.